Searching for new buyers

The population segments growing most quickly aren’t traditional boaters, so marine businesses in pursuit of a bright future will need to appeal to a more diverse group.

When the recession started to rattle his family’s 55-year-old dealership a few years ago, Bob Pappajohn of M&P Mercury Sales Ltd. in Vancouver throttled up his considerable networking skills in the local business community.

While socializing in the city, he began to learn more about the area’s large and affluent Asian population and caught wind of the fact that a number of these professionals were showing interest in boating, even though they had never participated in the sport before.

“Recreational boating is completely foreign to this group. Their fathers didn’t own boats,” says Pappajohn. “Yet they express interest in the lifestyle. We realized there was potential there and then we did something about it.”

What he did to attract and accommodate this relatively untapped market was reinvent the way his boat and motor dealership did business. He hired interpreters to lower the language barrier; he educated himself and his staff on this unique community’s culture and the protocol required to sell to the group; and he developed training programs to help these new owners become competent boaters,

thus answering concerns expressed by many that they knew nothing of the skills required to keep a crew safe and comfortable on the water.

These efforts, and others, paid off. Today, M&P Mercury is selling more than half of its volume of Brunswick boat brands to this market. Five years ago, the company’s sales to Asians were about 5 percent.

“Our success has hinged on the fact that we’ve been open to doing things differently and we try to avoid thinking that what worked in the past will continue to work in the future,” says Pappajohn.

Time for change

Pappajohn’s story is an important one. It illustrates the benefits of searching out new buyers in a tough economy and then developing a marketing message and programs to earn their business. Even at the risk of abandoning the sales strategies that seemed so ironclad in the past.

“We didn’t want to sit around and wait for our traditional customer base to come back, because we knew if we did we’d be waiting forever,” he comments. “The market as it was isn’t going to come back.”

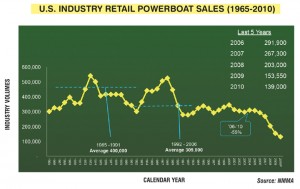

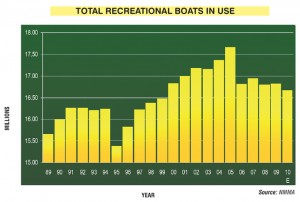

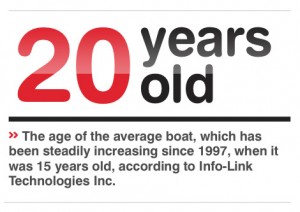

While some people in the industry may argue with that last statement, few will deny that they are challenged in their efforts to grow their businesses today. Numbers compiled by the National Marine Manufacturers Association (NMMA) bear that out. New powerboat sales are now at historic lows. In 2010, approximately 142,330 units (outboard, inboard, sterndrive and jet boats) were sold retail. That’s a steep drop from the unit sales reported at the height of the market back in 2001, when 317,900 powerboats went out the doors of dealerships nationwide. And the picture looks more troubling when you add to those numbers the fact that the number of boats in use has started to decline after a 15-year up cycle, and the primary boater demographic is shrinking as a total percentage of the population.

“Can we get back to selling 300,000 units? Not if we keep doing what we have always done,” says Thom Dammrich, the NMMA president, who advocates for the need to market boats and the boating lifestyle to new customers in untapped segments. “The business isn’t healthy today, so we have to do something different if we want to grow boating.”

Dammrich is quick to note that the message most companies send about boating is one that can resonate with any audience. Boating, he says, is all about spending quality time with family and friends and enjoying the outdoors. But he encourages the industry to take a close look at how that message is presented and whom it’s going to.

“Most of our product catalogues, our advertising and magazines feature white middle-aged men,” he says. “If we want to make the sport appealing to other groups, we need to include them in the picture, so that these people can envision themselves as boaters and become engaged.”

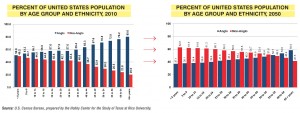

To support that argument, he quotes more numbers: “If you look at any demographic trends, you know the U.S. population is expected to grow by 140 million over the next 40 years. Only 7 percent of that growth will be in the white population. So if we want to grow boating, we have got to find a way to reach out and attract non-whites into the lifestyle in greater numbers.”

That’s something the NMMA is committed to doing. For example, in the “Welcome to the Water” campaign developed by Discover Boating, more non-whites are shown in the print materials and on the Web.

“Are we doing enough?” asks Dammrich. “I’m not sure, but we’re doing more than we used to.”

The generation gap

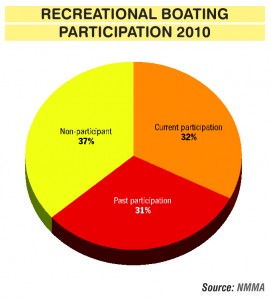

While new boat sales figures are discouraging, there’s promising news on another front. According to the NMMA, participation in the sport is up. Of the 231.5 million adults living in the U.S. in 2010, 32.4 percent, or 75 million, participated in recreational boating. This is the highest proportion since 1999, when 33 percent of adults went boating. Also interesting is the fact that current boating participants are likely to be younger than 50.

This statistic has attracted the interest of one professional marketer who recently gave the keynote address at the Marine Dealer Conference and Expo. Cam Marston is president of Generational Insights and an expert on the impact of generational characteristics and differences on the marketplace.

When it comes to growing business on the marine front, his advice to dealers and manufacturers is to steer clear of what’s been called a one-size-fits-all sales strategy. According to Marston, a marketing message that resonates with one generation may turn off another, and cost a company many sales.

So how does that relate to a growth in boating participants under the age of 50? Marston notes that this audience of potential buyers is made of Generation X (32 to 46 years old) and Millenials (31 and younger), while he’s observed that many of the people running marine businesses and managing sales today are Baby Boomers (47 to 65).

“Most people will sell and provide service in a way that they themselves would prefer to be approached, but some of the things that are meaningful to a Boomer are of no interest to a younger person,” says Marston. “The relationship between that Boomer and a younger customer has the potential to go wrong if the Boomer isn’t very clear on who that buyer is, how he prefers to receive information and how he makes a purchasing decision.”

According to his research, younger buyers are “stalkers” of information. They do extensive research on a product before they even enter a showroom, so when they get to a salesman’s desk, they’ve already sold themselves on the boat. They’re often ready to make a transaction and in many cases, they’re not interested in building a relationship with the salesman before writing a check. Boomers, on the other hand, are big fans of relationship building, and they also put a lot of stock in the value of a company’s credentials. They’ll often tout their business’ achievements and tell its story. And that’s when the conversation can sour.

In an effort to “stay relevant,” Sea Ray Boats is reaching out to the 20-something generation. Some of the initiatives it has been pursuing or will pursue as part of this effort are:

• DJ Sea Ray: In 2012, the boat brand is giving event attendees the opportunity to tweet song requests to @SeaRayBoat and use hashtags like #AquaPalooza. Those at the event will be able to add their favorite songs to the musical line-up for the weekend. Then, Sea Ray will share the playlist with all of its fans for them to download to their desktop or smartphone.

• Partnerships: In December, Sea Ray partnered with brands like Hyperlite and HO to give Sea Ray followers exclusive promo codes to receive 15% off their purchase.

• Sea Ray App: In January, Sea Ray launched a new iPad application along with an interactive boat show display.

• Alternative avenues: Not only is Sea Ray on Facebook, Twitter and YouTube, within 48 hours of the launch of Google+ business pages, Sea Ray was there.

“Simply using traditional avenues won’t work when you’re working with [the younger] crowd. Our team is constantly working to stay on top of all the latest trends,” the company stated.

“Younger buyers are more cynical,” says Marston. “They question authority and they don’t believe that a company’s longevity or standing automatically implies expertise. This buyer just wants to know how the boat will help him stand out in the crowd when he pulls into a marina. This buyer wants to hear a very different message than the one the older salesman prefers.”

Thus, with younger buyers on the horizon, Marston encourages marine professionals to really get to know this demographic. He suggests that the first step is to be aware of the generational differences, and with that awareness will come change.

Best practices, says Marston, include investments in information. Websites, for instance, should have rich, detailed content to satisfy these young buyers who will plumb the depths for facts about the product they’re interested in.

“A Boomer may argue that this type of information is meant to be imparted by a salesperson who is trained to deliver it when a customer arrives at the dealership,” says Marston. “My reply to that is, if you don’t have it online or in a document someplace, the younger buyer will never come to your showroom.”

For this reason, educating the sales staff on generational differences is key. “Managers have to pull their staffs aside and talk about the Matures versus the Boomers, Generation X and Millenials. Historically, a sales team has been all about the product — the length, the beam, the specs. The effective sales team of the future is keenly aware of how the product and the sales message itself applies to the lifestyle of a particular generation.”

Although Marston notes that it’s difficult to draw comparisons between the marine business and other industries, he says boating professionals can learn a few things about cross-generational selling from the automobile industry (“the evolution of Cadillac is one to study”) as well as the armed forces.

“They do a good job of knowing their markets,” he says. “Take a look at what they’ve done with recruitment. Their website has content tailored to both Millenials who may enlist and to their parents, the boomers who will also do the research.”

For those marine companies writing long-term sales plans, a good segment to focus on now is Generation X, since this group is in the process of raising children.

“If I was a dealer, I would be working hard to encourage that group to take their kids on the water since statistics show those who buy boats typically spent time cruising in their youth,” he concludes.

Locating the target

While there’s a big benefit to marketing boats along demographic lines, another organization is experimenting with a different approach. The Recreational Boating & Fishing Foundation (RBFF) recently hired a strategic marketing research firm to conduct a study on the behaviors that motivate people to do a specific activity, such as boating.

“Rather than just study age, gender or ethnicity, we looked at the national population of all people over the age of 18 and segmented them into categories based on their behaviors and on the things that motivate them,” says Frank Peterson, RBFF’s president and CEO. “We discovered five segments of the population that show promise for the fishing and boating industry. Of those segments, we’ll focus on two groups and develop marketing messages specifically tailored for their interests.”

One of the target segments has been dubbed “family outdoors.” It represents 10 percent of the population, and it’s composed of people who value the time spent and memories made with their loved ones outside. The problem with this group, says Peterson, is that they’re involved in many activities when they’re in nature, from hiking to backpacking. Fishing and boating aren’t really in their mindset.

To attract the attention of this group, RBFF is launching marketing campaigns designed to appeal to them. One of them reads something like this: “Mother Nature’s Water Park: Where the Only Lines are in the Water.” The language is designed to appeal to the group’s family orientation, and the marketing materials will represent women heavily, since statistics show the lady of the house makes 70 percent of the decisions on what the family will do for recreation.

The new campaign will also stress the idea that boating can be affordable. “That’s a big deal today,” says Peterson. “And we want this group to know that if you’re already out there camping and hiking, you can add fishing and boating to your trip affordably.”

The second group to be targeted is called “outdoor enthusiast” and represents 9 percent of the population. This segment is made up of people who are already involved in fishing and boating, but RBFF will market to it because the organization sees this group as mentors for the next generation of boat owners and anglers.

“These people are motivated by fun,” he says. “They recharge by relaxing, and they like to pass on the joy that the sport gives them.”

In addition to those groups, the RBFF will also run a program this year designed to attract what Peterson calls the “lapsed population.” It consists of people who used to boat and fish but don’t do it anymore; this population consists of all demographics, genders and age groups. It’s not just the older guys.

“There are 480,000 people in this county who have boats and have not registered them,” says Peterson. “Yet what we know about them is that they remember the fun and occasionally feel guilty that they haven’t passed the experience down to their kids. We have to give these people a reason to get back into it.”

To address this group, the RBFF has tailored messages such as “The fish are in the water; shouldn’t you be in your boat?”

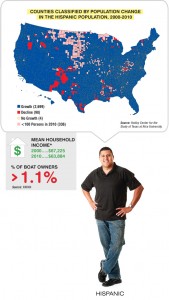

As for long-term marketing plans, the RBFF’s research shows that over time, the large and still growing Hispanic population could represent a strong market.

“Everyone wants to go there now, but it’s still a challenge,” says Peterson. “[Hispanics] earn less income, for one thing, and there’s no track record of how they buy since this is a relatively new phenomenon. But there’s potential there for the future.”

Even with valuable new research to work from, Peterson acknowledges that one of the best practices a marine professional can employ is one of the most basic. Know your customer.

For its part, the RBFF engages with its audience on an annual basis through a direct mail campaign. The organization has reached out to 10 million people over four years, and as a result brought 10 percent, or 1 million people, back into the sport.

“We did that simply by communicating with the right message,” says Peterson. “That’s not to say this an exact science. No one has all the answers. But there is no doubt that the more you understand a group, the better you can tailor your message, your offer and your timing to that audience.”

An industry united

Searching out new buyers was a key point of discussion at a recent conference hosted by the NMMA. The Recreational Boating Stakeholder Growth Summit drew 160 leaders from all segments of the marine business to Chicago in mid-December for an event that’s been called the largest and most diverse all-industry discussion ever.

“It was magnificent,” says Brunswick CEO Dusty McCoy. “The industry is now looking at all of the demographic changes that are occurring and realizing that this is perhaps the greatest opportunity we have had for growth in 50 years.”

As for its own strategy for success, Brunswick has been carefully scrutinizing the changing demographics for years. Now, the company is working to change the way it thinks.

As for its own strategy for success, Brunswick has been carefully scrutinizing the changing demographics for years. Now, the company is working to change the way it thinks.

“Traditionally, we’ve been focused on the product; on how to get it marketed, sold to the dealer and then to the consumer,” says McCoy. “Today, our focus is on specific customer segments, and how to satisfy each one individually. We’re working very hard at it and we’ve invested a lot of money.”

While the bulk of this work has been internal to date, McCoy says in the coming months, Brunswick will begin to work with dealers to help them attract these new customer segments. In his mind, the opportunities are rich. In fact, McCoy feels future sales for new boats have the potential to hit the half-million unit mark last seen in the early 1980s.

“I’m genuinely excited about the future because the industry as a whole is coming together to look at the issues,” he says. “We are no longer treating ourselves as victims of the economy, because it is what it is. While going through the economic downturn hasn’t been easy, it’s allowed those of us in the industry to be less constrained by past thinking. We now have people who are open-minded, believe in change and know that more change will be required. We also realize that we have to work together to create the best experience for the consumer and grow our businesses in the process.”

* Mean Household Income refers to male householders, ages 35-55, within the United States. Source: U.S. Census Bureau, prepared by the Hobby Center for the Study of Texas at Rice University.