New waves in water sports

Following amazing 2012 season, new trends and uncertain weather are shaking up the water sports market

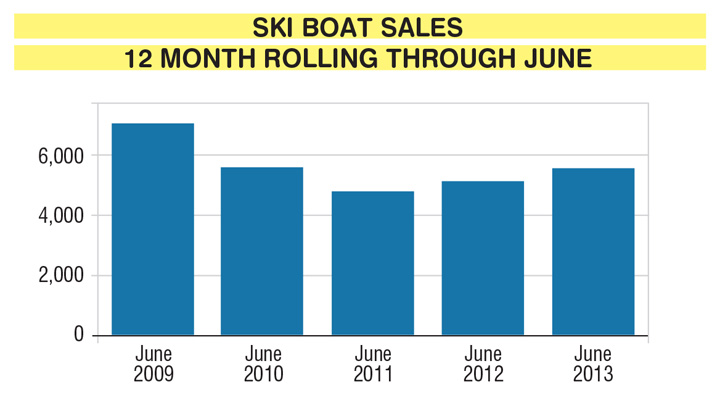

In terms of weather, 2012 was better than amazing for the boating industry. Summer in much of the United States last year started early, stayed strong and lasted longer than usual. At the same time, an improving economy was finally starting to impact boat sales and, after four backbreaking years, things were looking up.

As boat sales began to perk up, sterndrives still lagged while other sport boat categories began to show solid growth as outboard sales surged and new water sports started hitting the scene, injecting a much needed cool factor into the most youthful, visible part of the marine industry.

Wakesurfing — following close behind the boat and riding the wake as an endless wave — has quickly become one of the most popular water sport activities in America. Wakeskating, a physically demanding sport much like skateboarding on the water, is growing quickly and attracting a younger crowd. Beyond the newcomers, wakeboarding remains popular and some industry watchers think waterskiing may even be poised for a comeback.

Unlike 2012, many dealers, marinas or manufacturers won’t remember 2013’s summer in positive terms, as unusually persistent weather patterns brought cooler, wetter weather for much of the country. While the weather has been a drag on boat and accessory sales, new water sports have given boat builders new engineering targets to reach, as well as new customers that are discovering the rush of towed water sports for the first time.

Boating Industry spoke with the Water Sports Industry Association, Nautique and Tigé, as well as a trio of equipment companies, O’Brien, Liquid Force and Full Throttle Water Sports, for an in-depth look at what’s shaping today’s water sports industry.

New sports, increased relevance

Larry Meddock has been executive director of the Water Sports Industry Association (WSIA) for the last nine years, representing all things related to towed water sports, including tubing (by far the most popular), skiing, wakeboarding, wakeskating, wakesurfing, knee boarding, cable parks and parasailing.

In his tenure, Meddock has presided over a group that has become more focused, effective and influential. He has worked within the organization to turn good ideas into actual results.

“We all came together twice a year with 24-karat gold intentions to try and do something for the industry, but all of us had very important jobs and busy desks when we got home,” Meddock said. “All those wonderful ideas that we talked about during the board meeting would get set aside, and then we’d re-gather six months later and say what did we really do, and the answer was not much.”

Today, the WSIA has achieved a level of relevance that makes its members proud, Meddock said, and increased its standing in the eyes of many facets of the government, including the Coast Guard and state-level agencies that now look to the WSIA for guidance with legislation, safety guidelines, rules and regulations.

One example of the association’s ground-level work comes from the explosion of wakesurfing, where riders are towed close behind boats to ride a wake that, in most cases, has been modified to create a larger, offset wave. To those who’ve never witnessed wakesurfing in action, including law enforcement, the activity can look strange and disconcerting given the rider’s proximity to the transom.

While wakesurfing is done behind sterndrives or jets — nothing with an exposed, rear-mounted prop — the WSIA has fielded complaints from riders who have had law enforcement officers stop them from surfing, because it appeared as an immediate safety concern. In such instances, Meddock contacts law enforcement directly to educate them on the sport and, hopefully, allay their concerns.

“It’s our job to educate that law enforcement agency as to why it is safe,” said Meddock. “Forty percent of what I do every day is interfacing with different states … educating law enforcement, DNR, fish and wildlife, sheriffs, marine patrols of every flavor you can think of, educating them as to what it is they are seeing in the water, what the rules are, is it safe, is there carbon monoxide involved, is he too close to the transom, all of the ins and outs of these activities.”

Surfing and skating are relatively new, and the social aspect of both sports, like wakeboarding, encourage a full boat for a more aggressive wake. Meddock said the opposite desire — a nearly weightless, empty boat — as well as wanting pristine water are two factors that led to the partial reduction of waterskiing’s visibility.

“Instead of telling all of your friends to stay on the dock because you didn’t want their sorry butts in the boat, you wanted as many butts as you could put in the boat, because the more people you put in the boat, the bigger the wake is going to be, so now you’ve brought along your own cheering section,” he said of the newer sports.

While wakesurfing has been around for more than 50 years, it’s taken off within the last five years and is “like bringing surfing to Kansas.” With the right body of water, the right driver and the right boat, a rider can theoretically surf forever, or until the gas runs out.

Its low-impact nature means riders can fall all day long without injury, which has opened up surfing to a wider audience, including older riders who moved away from the demands of wakeboarding and skiing. Boat builders have responded with modified hulls and adjustable ballast to produce larger wakes, which has become a major selling point.

“It’s a full-court press to show the consumer that their boat is the best boat for wakesurfing on the planet,” Meddock said. “I think that speaks to the importance of wakesurfing and its relevance in our marketplace today that all of your major brands are building products specifically for wakesurfing.”

Cable park proliferation

Germany, a country that’s slightly smaller than Montana without the plethora of lakes in the United States, has witnessed a proliferation of cable parks that some predict will be replicated here. At cable parks, a mechanically powered cable pulls skiers, boarders, skaters or surfers across the water, affording them an easy way to ride, without the need for a boat.

Understandably, some boat builders reacted negatively, fearing the parks would reduce boat sales. Correct Craft, Nautique’s parent company, took the opposite approach and actively invested in cable parks, speculating that they will act like Little League, grooming a new generation of riders that will eventually be seduced by the freedom and power of a boat. Correct Craft purchased the Orlando Watersports Complex cable park in 2012, and has plans for a second factory-owned facility.

Meddock says Germany has more than 80 cable parks, which could provide a roadmap for states like Kansas, Nebraska, Oklahoma and Texas where large bodies of water are scarce. He predicts there will be 100 parks within five years in the United States, up from approximately 25 at present.

“The boat manufacturers saw the cable park guys as a threat when they first hit the market in the U.S. and they were afraid the guy that would frequent the cable park wouldn’t buy a boat — what’s happened is just the opposite,” Meddock said.

Leading the industry

A company built around water sports, Nautique CEO Bill Yeargin connects with his audience through his “Nautique Insider” blog that is intended to give enthusiasts insight into the company and build an emotional attachment to the brand.

As one of the world’s leading ski boat manufacturers, Nautique actively monitors water sports trends like other brands, yet tries to use its position to lead the industry in terms of technology and direction.

“We don’t look at ourselves as being market driven — most companies are market driven, so they look at the market and say what does the market want and then try to engineer, design, build what the market wants,” Yeargin said. “We’re driving the market and we’re giving the market new things they didn’t know they wanted.”

Part of that innovation has recently included the development of the Nautique Surf System that allows operators to switch the wake’s wave from side to side, as well as modify its shape, at the press of a button. The system’s integrated Waveplate redirects the flow of water coming off the boat, which changes the wake without moving passengers around on the boat or offloading ballast water.

Yeargin cited a similar roster of qualities that have made wakesurfing so popular — lower speeds, painless falls and appeal to a wider audience.

“Wakeboarders, water-skiers and wakeskaters are getting older like myself. It’s a low-impact way to keep those of us who love watersports fully engaged in the industry as we age,” he said. “It’s definitely the perfect storm of factors and technologies.”

Perhaps it had something to do with being interviewed during the 71st Water Ski National Championships, which attracted hundreds of skiers to West Palm Beach, Fla., but Yeargin downplayed the idea that waterskiing is in decline.

“There are a lot of [young people] in this sport and you look to the kids and teenagers … because they’re the future, and they’re as enthusiastic about it as their parents,” Yeargin said. “I think the wake sports have brought a lot of people into our industry, and they’ve expanded the industry, but waterskiing is still alive and well.”

Spurring innovation, new markets

With new activities requiring new characteristics from the boat, the major sport builders have had to respond with new technology, specifically when it comes to making larger wakes.

“Designed from the wake up,” Nautique’s G-Series boat was honored as the WSIA’s Most Innovative Product in 2012. The G23 is aggressively styled, but received accolades for its hydro-plate technology that adjusts the hull’s surface using internal ballast for a larger wave. Yeargin credited the new sports for spurring innovation throughout the industry.

“We were fortunate to be on the innovative side and have the cool new product, but it’s made everybody else better,” he said. “It pushes us, we push each other — they’re all good companies and so the more we push each other, that drives innovation, that drives customer service, it’s really good for the customer.”

A less visible innovation at Nautique has been its use of athletes and events to help demonstrate the various water sports in countries that are unfamiliar with them.

While its Wake Games, held every April, is a chance for high-profile and up-and-coming amateur riders to show off their skills here at home, some of the company’s international events are organized to show the public what these sports are, how they are done and to create an initial buzz behind a sport that, in many emerging markets, is very much on the fringe.

Yeargin mentioned a trip last year to Kuwait, a country without any sort of waterskiing or wakeboarding culture. The company took one of its athletes, set up an event through a local dealer and invited influential people from the area.

“In the U.S., almost everybody’s been on a boat or been waterskiing or wakeboarding at some point at least once in their lives,” he said. “There it’s like, ‘Oh, I didn’t know you could do that, what’s going on?’ It’s a ton of fun.”

Adding life to the company

Based in Abilene, deep within the flatlands of west-central Texas, Tigé Boats bills itself as a wakesurf and wakeboard company, a sign of surfing’s newfound prominence that many manufacturers are betting will stick around for years to come.

Tigé president Rick Correll has dedicated the company’s engineering resources to building bigger, surf-friendly waves behind its latest models. Likening sport boats to athletic equipment, he wants his company to be at the forefront of the trend. It claims its new Convex VX hull produces the “biggest, cleanest and most powerful surf wave ever created behind a boat.” The company is also developing a new boat to be released this fall that, Correll says, will dramatically change the wakeboard and wakesurf markets.

He added these new engineering challenges have added tremendous life to the company, and has made this the most fun job he’s had in an approximately 30-year marine career.

“This is about producing something that has dramatic changes in the ability to customize the boat to the owner,” he said.

Today’s water sports boats “have the ability in your boat to control both the lift of the boat, the weight in the boat and the speed of the boat very precisely,” Correll said. “We have four ballast points with different pumps and measuring devices so you can exactly weigh a boat and save it for the next time you want to run and it will save your speed, your plate settings, your weight and re-setup the boat for you to reproduce that ride, because it can be a lot to try to remember every time.”

Beyond surfing, Tigé is also betting on wakeskating — currently a small niche, but one that’s predicted to continue growing in popularity. The company also sees a slight uptick in waterskiing, which it attributes to a widespread public interest in health conscious activities that’s boosting the entire water sports category.

To reach skating’s young, athletic audience, Tigé has tweaked its marketing by releasing new videos every two weeks, sometimes just two-minute clips. Correll stressed the importance of third-party messengers as valuable sales tools, rather than voices from within the company.

Ballast baggage

As the market demands ever more complicated boats with elaborate ballast systems, sport boat prices have skyrocketed. Constrained economies of scale and raw material prices are major factors, and Correll worries the sky-high boat prices are pushing people out of the market.

“Five years ago we produced a boat that didn’t really have any ballast in it, just a little pipe tower and toggle switches on the dash,” he said. “Now everything is operated through touchscreens, automated ballast systems with multiple pumps, inclinometers, gyroscopes, GPS, heaters, showers and all of these things have evolved in the boats, so the content has gone up, as has the price.”

With advanced ballast systems comes another added cost: more engineering and safety testing. Sport boats with ballast can lean drastically to one side or another. Safety and endurance testing must respond in kind, accommodating the extremes of all possible ballast settings to make sure the boats are infallibly safe.

“When you just had a throttle and a steering wheel that was one thing,” Correll said. “Now you have ballast and you’re putting water in, leaning the boat over to one side and … you have to put in safety measures that don’t allow the operator to make mistakes like trying to run that boat at top speed with only one side of the boat filled with ballast.”

Tubing is still king

Speaking with the boat builders and perusing the enthusiast media, one could get the impression that surfing, skating and boarding have all but buried the old-fashioned tow-behind tube. To the contrary, WSIA’s Meddock said tubing sales still comprise approximately 40 percent of all products sold in the billion-dollar water sports industry.

For a greater look at the accessory and toy side of the market, we spoke with Mary Snyder at Full Throttle, Don Wallace at Liquid Force and Pete Surrette at O’Brien Watersports — all part of the Absolute Outdoor conglomerate that covers the water sports market from $120 towable tubes all the way up to $500-plus wakesurfers.

At the entry-level, both in terms of price and required skill level, Snyder, vice president of marketing at Full Throttle, said the company’s tube business has grown for the last several years. So far in 2013, with sub-par weather conditions, she expects the company’s sales to end up flat or with slight year-over-year growth.

“We’ve had growth in the tube business so we know it’s still a very popular activity for people,” she said. “I think the bigger thing there is the whole lifestyle piece where you get family and friends having a good time on the water and they want to be together, so you see more than one person out there at a time.”

To widen its audience, Full Throttle has developed more athletic tubes, including the Speed Ray models that have wing-like fins for added lift at speed.

Surrette is executive vice president, general manager at O’Brien. He interacts with all aspects of the market, as the nearly 50-year-old company sells tubes, vests, kneeboards, skis, wakesurfers and wakeboards. While 2012 was a great year for the company, 2013 has been weaker in hard goods like boards and skis, while the towable tubes and PFDs have increased sales. Recent declines in boat usage have spurred the company to invest in stand-up paddleboards, which many dealers have also begun carrying.

One challenge for O’Brien and others is that hard goods can last a very long time, while vests and tubes tend to wear out within a few years. Another factor is continued economic weakness, which has made higher-end sporting goods one of the last of the company’s segments to recover. Surrette points to lackluster sales in the 19- to 24-foot runabout segment, which has shown to be the most influential category to monitor for sales of the company’s hard goods.

In the water sports equipment market, a challenging summer like 2013 can have lasting effects that ripple through the books beyond a year and impact product orders for the following season.

Companies like O’Brien work for 12 months designing and producing products for a short, four-month-long selling season. That means if a summer is a dud or consumers dislike a certain style, Surrette said, it can take months of work to implement changes at the point of sale.

Liquid Force, a high-end maker of wakeboards, wakeskates, wakesurfers and party accessories has seen a stronger year thanks to improving boat sales and dealers that ordered early and stocked up after a successful 2012 season.

“Most inboard boat retailers, which makes up a large percentage of our dealer base, have reported solid boat sales and again, and that has a direct correlation … on how accessories like ours sell,” said Wallace, vice president of sales and marketing at Liquid Force.

Looking ahead to 2014, he sees wakesurfing as the company’s biggest opportunity, even though the sport requires users to have a specific type of boat.

“It seems like the [wakesurfing] sales continue to skyrocket year after year,” he said. “While it is true that the limitations of what type of boat can be used hampers the potential to some extent, we definitely aren’t close to the ceiling by any means.”

An early supporter of cable parks across the globe, Wallace said the parks are already a big factor in its business, with specific products aimed at cable enthusiasts.

“We really believe in cable and know that it can only help grow our sport. While we all want to own boats, not everyone can,” he said. “While boat riding is still our most important market, cable is a great market that continues to bring a ton of new participants into the sport.”