Market Trends: Return of the Jet Age

Major boat builders are releasing an array of new jet-powered boats

Sales of jet-powered boats fell steadily throughout the last year, partially due to Bombardier Recreational Products’ [BRP] surprising decision in late 2012 to abandon production of its Sea-Doo jet boats. Almost a year later, this past September, Sea Ray announced it would no longer enter the jet boat market after going so far as showing off prototype models to dealers and consumers. With this recent history, reasonable market observers might think this is the end of the marine industry’s nearly 60-year foray into jet technology. Logical as it may seem, they would be wrong.

Starting this year, a new wave of jet models are coming out from major manufacturers that marks a significant reinvestment into the alternative, high-performance power source that is set to shake up the entire marine industry once again.

Welcome back to the jet age.

Growing ranks

Jet-powered boats have been around since the 1950s, but didn’t go mainstream until the big manufacturers jumped in and sales of personal watercraft and jet boats took off in the 1990s. Their allure remains the same as it always has been: thrilling acceleration, a more compact powertrain and the lack of a spinning propeller off the stern.

Yamaha and Sea-Doo were the primary players in the jet boat market until Sea-Doo’s exit in 2012. Even before Sea-Doo left the category ahead of its parent company’s initial public offering last spring, jet-powered boats have comprised a small fraction of the marine market.

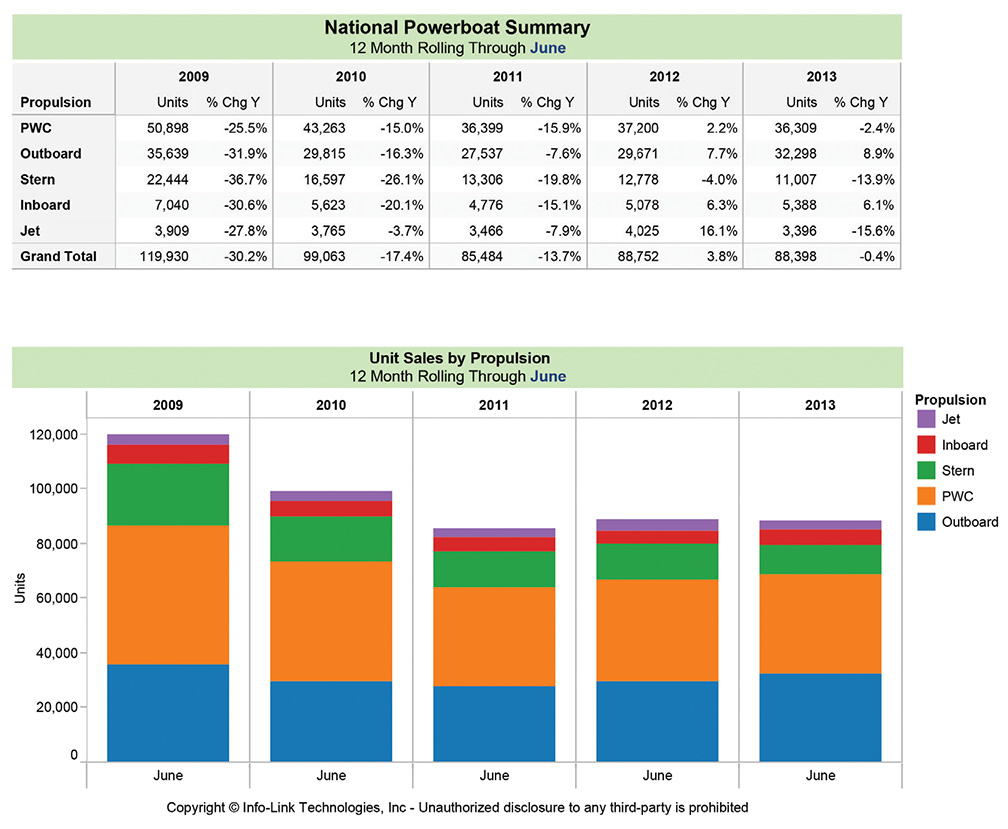

Combined with personal watercraft, however, jet propulsion accounts for nearly 45 percent of the American powerboat market. According to data provided by Info-Link, annual jet boat sales have hovered between 3,300 and 4,000 since 2009. Sales declined 15.6 percent over 2012 through June of 2013 with a total of 3,396 units sold.

Even without sales growth, the last 12 months have seen an explosion in interest in the technology from major boat builders including Rec Boat Holdings, Marine Products Corporation and Sea Ray, which ultimately decided against entering the market after much speculation.

Following its departure, BRP agreed to license its jet powertrains to both Rec Boat Holdings and Marine Products Corporation, and it’s possible BRP may sell the technology to even more companies in the future.

However it plays out, the marine industry is set up for an unprecedented introduction of jet-powered boats that will shake up the market and, according to experts, will likely spur innovation to further advance the industry’s latest jet revolution.

Rec Boat Holdings leading the pack

Roch Lambert, group president at Rec Boat Holdings, has had a wild eight months since his company announced that it was entering the jet boat market with the re-launch of the Scarab brand last May.

RBH showed off its products to consumers for the first time at the Ft. Lauderdale International Boat Show in October. Three jet-powered Scarabs, as well as the Glastron GT187 had already begun rolling down the assembly line a few weeks earlier, and the first models were delivered to dealerships shortly thereafter.

Three entirely new Scarab models are all variants of the initial 195: Standard, HO and Impulse. Standard, the base model, will be powered by a 200-horsepower Rotax engine, while the HO and Impulse, the sportiest model, will be powered by 250 hp engines — all licensed from BRP.

The Impulse will include a tower and be dressed in bolder, more energetic color schemes to appeal to a young or young-at-heart demographic with names like Laser Red, Sunburst Orange and Vivid Green. The Standard and HO will both be available in black or blue colorations. Glastron’s GT187 model is a spinoff of an existing runabout design, sporting a redesigned hull to accommodate the jet propulsion system.

Lambert is particularly excited about the styling of the Scarab models. The bright colors and sharp angles take a cue from the company’s recent move toward sportier designs, as evidenced by the latest SS and RS from Four Winns and the Glastron GTS series.

Speaking about the accelerated timeline from announcement to production, he said the company “didn’t have any time for hiccups.” Lambert added that his team has been overwhelmed with the initial success of the project, namely positive reception from consumers and dealers, including MarineMax, the country’s largest dealer group, signing on as a distributor.

“There’s no question that when you have MarineMax on board it sends a huge message of credibility, not only for Scarab, but also for us as a company and management team,” he said.

Personal friends outside of business, MarineMax CEO Bill McGill was immediately interested in RBH’s jet line, and called Lambert back a few minutes after seeing Scarab renderings for the first time to arrange plans to get together to work out a deal.

Lambert suspects Sea Ray’s aborted jet plans likely assisted in encouraging MarineMax to sign on. In total, RBH has approximately 130 dealers confirmed to carry its jet products, with another 20 to 25 in the works, soon bringing its total North American dealer network to at least 150.

“Every single one of them was hand-picked, and we feel that we have probably one of the, if not the strongest, distribution network in the marine industry right now,” he said.

Chaparral’s Vortex

At Marine Products Corporation, Jim Lane and his team are busy deciding the best way to celebrate the company’s 50th anniversary. At the same time, the company has recently completed its distribution model for its upcoming push into the jet boat market.

After electing to offer its jet models to the Chaparral dealer network, Lane said the company was “overwhelmed with the number of positive responses that we got back from our dealers indicating their interest, their wish and their desire to carry the jet boat product line … we got quite a few rounds of applause from our dealers for selecting that course of action.”

Chaparral introduced its first jet boat model in December during its dealer sales training event near the company’s Nashville, Ga., headquarters that attracted more than 150 of the company’s dealers.

“We didn’t pick up any of the designs that BRP had with their product and we started with our own designs and have developed a boat that I think is going to be very well accepted in the marketplace and the reason for that is that boat will carry the Chaparral DNA, it will have the same styling, the same innovations, it’ll be a true bowrider, which is unusual in the jet boat market because many of those products have come from the personal watercraft,” Lane said. “We’ll be introducing a beautiful boat with exceptional styling as we introduce our first model and we’re planning on being in production with that boat by early January.”

The company is anticipating a total of three jet boats, 20-, 22- and 24-foot iterations, all ready for production by April. They will be named Vortex by Chaparral and, like RBH’s models, will be powered by a single and twin jet powertrains licensed from BRP.

“We’re looking at different price points, and I believe as the boat gets larger, twin power will be the choice for most of those customers,” said Lane. “What we’re trying to do is match the power to the boat so the customer has the best possible performance and he is happiest with the product.”

Chaparral expects its jet models to be priced “just as competitively as sterndrive,” and its testing has shown jet fuel economy to be similar to sterndrive in all situations, other than when running at wide-open throttle, where sterndrives carry the advantage.

“We feel like there’s great potential for growth in this market and … our dealers are projecting some very good numbers that they think they can do with the jet boat product,” he said. “I think with Sea Ray being out of the market, it only gives us a greater opportunity to market our product.”

Yamaha’s vision of family fun

With a line of 12 boats ranging from 19 to 24 feet in length, all powered exclusively with jet power, Yamaha is somewhat of an outsider in the North American marine market. After starting in the 1990s building “what were effectively big personal watercraft,” the company shifted its plan in 2000 and decided to focus on what it calls the family-fun segment.

Comprised of three traditional segments — runabouts, towable sport boats and deck boats — Yamaha sees its products like those of other mainstream boat builders. Rather than being defined by powertrain, Yamaha feels that its products instead just happen to be powered by jets — both twin- and single-jet engines.

“We could bring some previously unfound benefits in that market because of our very compact driveline, and so in 2003 we launched the first of what we call a family-fun boat, and they’ve been hugely successful,” said Yamaha WaterCraft Group President Mark Speaks. “We found a way to deliver a better product to that customer in that category and it was pretty successful, and there’s been no reason for us to change our driveline of choice.”

While the jet market has been flat, Yamaha recently completed a $3 million expansion of its jet boat manufacturing facility in Vonore, Tenn. The project included acquiring more land, a new R&D building and a new hull and deck assembly line that increased production capability by 25 percent.

As part of its expansion release last August, Scott Watkins, the company’s product planning manager, said, “Our unique approach to boat building, which includes our boats being Yamaha all the way through — the engine, the manufacturing and the dealer base, has really taken hold with customers and propelled us to the top of every size range we compete in. As a result our jet drive systems have risen to become the standard for performance, reliability and functionality from which all other family recreational boats are now measured.”

Two years ago, the company unleashed another jet investment: the Thrust Directional Enhancer [TDE], which was designed to improve the low-speed maneuverability of its boats — a frequent knock against jet boats.

“It effectively works kind of like a hydraulic steering device, almost like a hydraulic rudder in the water. The water thrust is diverted in a downward direction where it gets more traction, and it has a remarkable impact on the ability to steer a boat at low speed without having to apply more throttle,” Speaks said. “Any jet boat is very maneuverable if you’re willing to apply more throttle, but for a first-time operator we can make the whole experience better, and if we can make it even easier, all they have to do is turn the steering wheel like they do in their automobile.”

Rotax Jet Propulsion

As BRP remains in the market — minus its Sea-Doo jet boat production — the company intends to continue its investment in research and development to keep its Rotax Jet Propulsion system at the forefront of the industry.

“While we cannot comment on specific development projects, we can say that we have an R&D team dedicated to the Rotax Jet Propulsion business and that we intend to maintain our position as the technological leader in the market,” said BRP in a statement to Boating Industry.

The company sees that ongoing investment in innovation as a key selling point that has helped the Quebec-based company quickly attract interest from former competitors in the marine industry.

“The fact that we at BRP have designed the entire Rotax 4-TEC Jet Propulsion system as a system sets it apart from most other offerings,” the company said. “The Rotax 4-TEC engine was designed as a marine engine to work only with jet propulsion. We did not ‘marinize’ a car engine nor did we adapt a jet pump to work with an ‘off-the-shelf’ engine. Our entire system was designed by us to work together in the smallest possible package to maximize the available space in the boat.”

Its setup is currently the only complete line of C.A.R.B. 4-Star-rated jet systems on the market, covering its range of 150-, 200- and 250-hp jet powertrains. Each option is also available with CE certification for international markets, and the company cited the advantages of its closed-loop cooling system that keeps “raw” water from ever being inside the engine, which aids in salt water performance.

The company said its drive-by-white — Intelligent Throttle Control (iTC) — system is a significant asset that enables Cruise, Ski, ECO and Docking modes that make the system easier to use and, in some cases, more fun to drive and ride behind than comparable jet boats.

The appeal of jets

Jet aviation technology was a watershed moment in history, encapsulating the advanced technology, modernity and upward mobility that, for a time, only America could offer.

In the marine world, jets have always promised exciting performance, sharp handling and a more compact drive system that allows better access to the transom, especially important as recent usage surveys show boaters spending more time than ever parked in the water and having fun off the back of their boats.

While RBH has recently focused on making its sterndrive product more youthful, Lambert feels Scarab customers are going to take that mindset even further with its colors and design appealing to an even younger demographic.

“I think Scarab really takes it to another level where it really is not only graphics and color schemes, but the lines of the boats, the layout of the boat,” Lambert said. “It all really targets a group of people that we believe may not have considered a sterndrive boat in the past.”

The company has no plans to tell consumers that one power source is better than another, but will instead focus on the unique benefits that each propulsion system provides. For jets, that means talking about the superior acceleration, lack of a propeller, general maneuverability and the elimination of bow rise at takeoff.

With more flexibility to design a low, uncluttered transom, Scarabs will also appeal to a more active crowd regardless of age.

“You don’t buy a jet boat just to cruise around, you buy the boat to typically be more active with it and, certainly when we designed the stern area, we did that with the active family in mind without a doubt,” Lambert said.

Compared to its own existing customer base, Marine Products Corporation expects its Chaparral jet boats to appeal to enthusiasts with previous experience with jet power, likely through PWC, as well as skew somewhat younger than its other products.

“A lot of people that have used personal watercraft have become accustomed to the jet engine, and as they move into a boat some of them prefer the jet engine, some of them don’t, and I think that by offering a jet-powered product that we’re going to pick up both sides of that market,” said Lane. “Obviously some people that have had a jet move to sterndrive, but I think by having a sterndrive product and having a jet product with both carrying the Chaparral DNA, we’re going to hit both sides of that market and we’re going to be able to give the customer what they want.”

Lane likens the appeal of his coming jet boat roster to that of his company’s successfully H20 entry-level sterndrive lineup, likely attracting customers that are slightly younger. He added that his jet push aligns with the industry’s desire to bring younger people into boating.

“Certainly the goal of the National Marine Manufacturers Association has been to bring more people into boating and I believe that jet boats have brought more people into boating,” he said. “If you look at the numbers, just in 2012, the number of jet boats that were sold it was rather significant and the market share had been increasing to some degree and there was growth in that market.”

Like Chaparral, Yamaha’s research shows many people drawn to jet boats have previously experienced jet-powered watercraft, but Speaks said that has changed somewhat in the last few years.

“We find that our customers frequently have owned sterndrive- or outboard-powered boats in the past and the combination of features and benefits that come with jet drive appeal to them today,” he said.

To Yamaha, it doesn’t matter the number of boats sold that are jet drive. What is critical, Speaks said, is the number of boats sold in its self-defined family-fun grouping, including sterndrives, inboards and outboards.

“The fact that there are new companies getting into the family-fun category with jet drive product will be a good thing in that it helps take jet drive mainstream,” he said.

A new wave

As the first new wave of jet boats begin hitting the market, the impacts of this industry shift remain unclear. RBH has set ambitious sales goals for its jet lineup, with the anticipation that its jet-powered products will become a significant portion of the company’s volume and revenues within five years if not sooner.

“We have pretty aggressive targets [and] there are a lot of elements that will play a role in determining exactly how big that’s going to be,” Lambert said. “We’re ramping up new models just about every two or three months in the next year, so the full impact probably isn’t going to be seen until calendar year 2015. At that point, there’s no question that jet is going to play a very significant role in the overall revenue of our business.”

He added that within 12 months there will be a total of 8 to 10 new jet boats under the Scarab and Glastron brands, with more potentially coming in the future. When asked about the competition and the prospect of other brands jumping in, Lambert said his company is not intimidated by additional jet players, and would have made the investment regardless of Chaparral’s intentions.

So far, RBH is focused on the details of its multiple product launches, rebuilding the Scarab brand and fulfilling production orders that have already far outstripped capacity.

“I’ve launched a lot of products in my career and I don’t think I remember one that has been so unanimous in its reception with everybody that has seen it so far,” Lambert said. “We did not get into this game … because we thought that jet boats were going to boom. We just think that this is an option that we can very well master here and build a good success story out of it for our company. If you ask me today five years from now how big jet boats are going to be … I honestly don’t know. All I know is we’re very convinced that our team is going to make it a success for our company.”

As production is set to begin on Chaparral’s jet boats, Lane was reticent about his company’s sales projections. His team is preparing an aggressive marketing plan for its jet products that will coincide with the company’s 50th anniversary celebration. He is excited to show off the product to the dealers at its south Georgia facility, where they will get the chance to drive the boats as well.

“Dealers are very intuitive, and we’re anxious to see how they approve of what we’ve done,” Lane said. “I think they’re in for a very positive surprise.”

No matter what, 2014 will be a watershed moment for Marine Products Corporation as it unveils additional new models, including a 21-foot H2O and two new Robalos.

“We like to be innovative,” Lane said. “We like to offer products we know our dealers have an interest in where we can generate good market share for them and good market share for us, so our company has developed itself around very robust engineering department, and … we’ve introduced 24 models in the last 6 to 8 years and I think that’s key to any company, because one thing is always true, we know that new sells.”

As more players join its familiar niche, Yamaha remains confident about its 20-year head start in the category, and is looking forward to further competition inevitably driving both technological innovation and consumer interest.

“I’m not arrogant enough to believe that some of these new players won’t bring some new ideas to market that we haven’t thought of in the past, and I think that’s a great thing,” Speaks said. “People love new product, so the fact that Rec Boat Holdings and Chaparral are going to enter the market with some new jet-powered product means that some of the market with brand-new products are likely to gin up some interest among prospective boat buyers and we’re going to benefit from that.”

I owned one of the earlier Yamaha 23 ft. jet boats. The construction quality was poor and the dealer network didn’t know how to handle boat owners, at least not in NJ. My biggest complaint was long stringy weeds clogging the impellers. it was impossible to pass through a no wake zone without clogging. Then you had to shut off the engines, reach down the clean outs up to my shoulder, twice, and then re-start. Every time! I sold the boat after two, long frustrating seasons. I went to a slightly used Cobalt (my second Cobalt) and loved it. Has this clogging problem gotten any better? I would love to look at the Chaparral Vortex, but not if it is useless in lakes with the stringy weeds I mentioned before.

Glen. Unfortunate problem you have had. I have owned a yamaha jet boat for about 4 years and have only had to unclog tbe impeller once….when I sucked. A ski rope! I guess where you boat would didictate that. As for the build quality…..no, its not what you would get from a cobalt or chaparral, but it is fantastic for its price point. Comparing a 21 foot Yamaha with a comparable size from one of the above mentioned…..the yamaha will come in thousands less. One more thing…..if I’m not mistaken, NONE of these other new jet boats even offer the ability to clean your impellers tbrough ports on the top side. You have to swim under! If a jet boat is in your future, Id seriously look at Yamaha again. If your boating area is such where you are constantly going to be ingesting weeds and debris, you may want to stick with a prop boat.

I know my next boat will be a jet boat. We spend most of our time rafting up and anchoring in about thigh deep water and partying. When wave come lower unit bounces off bottom (not Good), also have bent three props hitting bottom in diffeerent areas. Only problem I see is I want bigger then 24 foot. Any news on a 27 or 32 footer coming out anytime soon?

hi there jim check out heckleyyachts.com they have realy hugh jet boats from 29 feet too 65 feet looking for 27 feet too 32 feet they have a 29 r wich is a 29 foot 2 inch jet boat with a cabin 9 foot 1 inch beam draft 1 foot 9 inch 8,200 pound wight 100 gallons of fuel water holds 20 gallons engine volvo 370 hp vdissel engine jets hamilton hj292 cruse speed 30 knots top speed 34 knots and the next one the new hinklely t34 wich is 34 feet 3 inches long beam 11 feet draft 22 inches 14,000 pounds 160 gallons of fule 35 gallons of water engines twin yanmar dissel 260 jets twin himiltion 242 jet drives criuse speed 29 knots top speed 32 knots heckely jet boats range in size from 29 feet up too 65 foot jet boats out now too

I looked at heckled yachts and they look awful. I don’t want a boat from 1950

Do you happen to have any details or other information on the 24 ft. Chaparral Vortex or same size Scarab? I hear they will be ready for the 2015 model year. I would love to read an article about them when more details are released.

Chaparral unveiled their 24-footer at their dealer meeting last week. Look for more coverage coming soon.

I’m thinking of buying a pre-owned Yamaha jet boat for use in the Florida gulf coast area. It will be used on the Intercoatal Waterway, bays and the open Gulf. We have a lot of skinny water here (1′ -2′ depth). Anyone have expierence with them in this area? Good or bad? Thanks

I owned a first year Yamaha 230. Kept it for two years. If you have long stringy weeds, as I did on our local lake, prepare to be shoulder deep in the access points clearing weeds that have wrapped around the impellor at no wake speeds. That was horrible and constant.

Also, I don’t know if it is better now, but the dealer was used to dirt bikes and jet skis, and did not treat a higher end boat buyer properly.

Finally, mine was very loud. Two small engines wailing away at 8,000 RPM’s can get annoying.

Lastly, for water sports, the new Yamaha, with its keel-like device should be fine, but previous versions without it created a tail wagging the dog experience.

I purchased the Scarab 21.5 jet boat in 2014 and it has been fun but has not lived up to the hype I expected. The dealer (MarineMax, Brick NJ) has been of no help when it comes to the most basic issues that come up.

I have a red “wrence” indicator light in my left side tachometer and of course there is no mention of what this could meen in the owners manual and MarineMax has been unresponsive. Would anyone there have an idea of how I can contact the manufacturer directly to get answers?

hi there mike i am dissaponted in the jet boat line up i am looking fot at least a 27 foot jet boat with a full cabin crusing capacity at least 13,000 btu ac heat 8 kw generator sleeps 4 or 6 gally tv 2 240 hp mercury v6 jet drives shower head see if i were jet boat compamies i would released a sea ray 270 sundanercer jet version and a chaperal 275 express cruser jet version and if i wete yamahha i would release a 24 foot too 32 foot cabin cruser with 3 jet drives

we build commercial aluminum boats and custom recreational boats — work with some of the best designers in the world — Hallmarinedesigns.com has some excellent designs or we could do something custom and cost effective…

nick

For Mike to contact Scarab

Scarab

925 Frisbie Street

Cadillac, MI 49601

(231) 775-1351

The jet boat you are describing would be ideal! Even a cuddy with bow rider section, like the Ebbtide, would be awesome. Jet engines, like the ones on the Yamahas, are the future. I have 6 years of trouble free boating, no exposed props, more speed, power, efficiency and simplicity. Less expenses for winterizing and service and no transmission. Please, Yamaha, give us a cuddy, a combination of cuddy and bowrider and a cabin cruiser. The market is yous to have!

Scarab Jet Boats is now up to a 25.5 foot twin jet. Capacity of 13 and optional full head. It is available in 300, 400 of 500 hp. choices. Pricing is from the mid 50’s to 70’s depending on options and power. All are first for the sport jet boat market. One year ago Scarabs chief engineer hinted on a triple jet (750hp) and sizes of 28-32′. Time for a new article to bring everyone up to date on the jet market. With the explosion in Wake Surfing, Jet is the leading choice for a family start up wake surf package. Surfing within the back of the boat and having the rear facing loungers makes for a fully interactive experience for everyone on board!

That’s what I’m looking for 27-32 foot range open bow/cuddy hybrid with jets. Can’t wait and I’m sure Yamaha will follow suit.

What would be a good year/model jet boat for a first time boat owner. I have a family of 5. Thank you, Ryan